Anticipation Builds Ahead of December 10 Fed Announcement Amid Mortgage Rate Speculations

We Love Lewisville-Clemmons! Newsletter

Archives

Anticipation Builds Ahead of December 10 Fed Announcement Amid Mortgage Rate Speculations

SIGN UP FOR OUR NEWSLETTER

Anticipation Builds Ahead of December 10 Fed Announcement Amid Mortgage Rate Speculations |

Mortgage Rate Update from Clemmons Resident, Nick Mason of Nexa Mortgage |

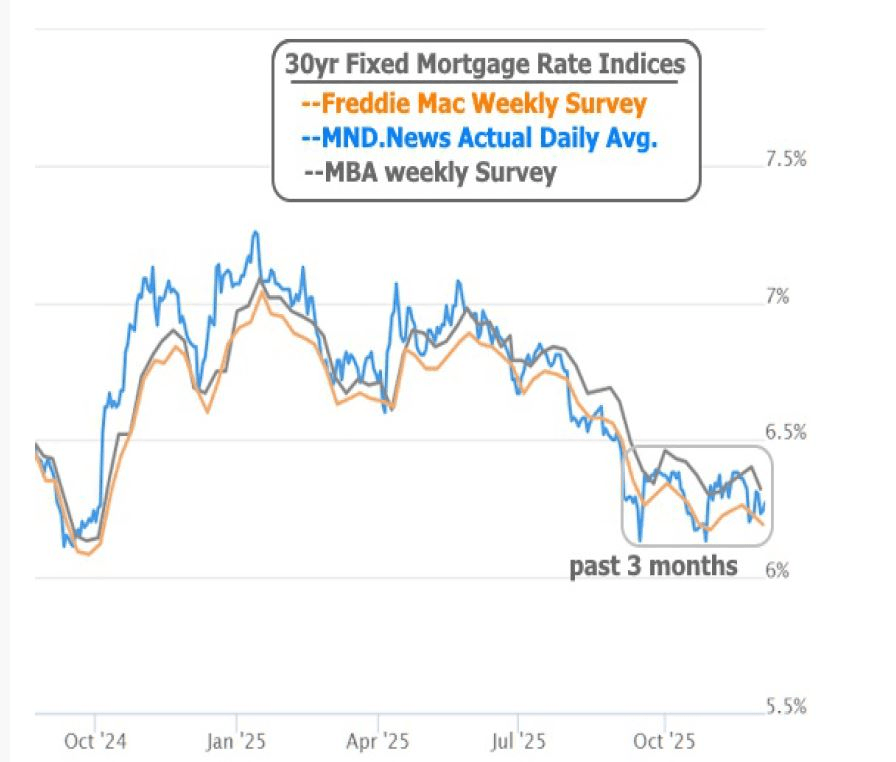

Hello, Lewisville and Clemmons neighbors! Nick Mason here from Nexa Mortgage. As the calendar quickly flips toward the holidays, the housing market continues to offer a complex and fascinating story. While we've seen a welcome easing of rates for the second consecutive week—bringing the average 30-year fixed loan into the low 6% range—we know that market stability is still the biggest gift on everyone's wishlist. With the critical Fed meeting happening right now, our focus for this update is to cut through the noise, clarify the factors (like that crucial 10-year Treasury yield) driving current costs, and help you find clarity on what this final month of 2025 means for your home buying or refinancing power.

December 10, 2025, is poised to be a pivotal date for financial markets, as the Federal Reserve prepares for its most consequential announcement in over a year.

Unlike previous meetings where rate decisions were largely anticipated, this upcoming session introduces a degree of uncertainty that has captured widespread attention.

Market analysts are currently assigning an 87.2% probability to a 25-basis-point rate cut, as indicated by the CME FedWatch Tool.

This level of confidence, while substantial, falls short of the near-certainty often observed in past rate decisions.

Such a scenario opens the door for potential surprises that could ripple through various financial sectors.

However, the implications of a rate cut extend beyond immediate market reactions.

Long-term interest rates, including those affecting mortgages, are influenced by a complex interplay of factors.

Notably, this meeting will feature the Federal Reserve's "dot plot," a chart that reveals individual members' projections for future rate movements.

Should the dot plot suggest a more conservative approach to rate cuts in 2026, it could counteract the downward pressure typically associated with a rate reduction.

Adding another layer of complexity, Federal Reserve Chair Jerome Powell's press conference, scheduled 30 minutes post-announcement, offers an opportunity to clarify or adjust the market's interpretation of the decision.

His remarks have historically held significant sway over investor sentiment and market trajectories.

Compounding the uncertainty, the release of November's employment data has been postponed to December 16 due to a government shutdown.

This delay deprives the market of critical labor market insights that could have refined expectations ahead of the Fed's decision.

In the housing sector, mortgage rates have exhibited relative stability since early September.

As of early December, the average 30-year fixed mortgage rate stands at 6.19%, marking a slight decrease from the previous week's 6.23%.

While this rate is lower than the 6.69% recorded a year ago, it remains elevated compared to historical norms.

In the Portland metro area, the housing market has experienced notable shifts.

Data from Zillow indicates that the majority of homes across the country have seen a decline in value this year, the most significant drop since 2012.

Despite this downturn, most homeowners still maintain substantial equity in their properties.

The current environment is considered a buyer's market, influenced by persistent high mortgage rates and home prices that have constrained affordability and buyer activity.

As the December 10 meeting approaches, stakeholders across financial and housing markets are keenly observing the Federal Reserve's actions and communications.

The outcomes of this meeting could have far-reaching implications, influencing borrowing costs, investment strategies, and the broader economic landscape.

Given the intricate factors at play, from the dot plot projections to Chair Powell's commentary, the forthcoming announcement is set to be a defining moment in the current economic cycle. |

If there's one potential economic data wild card before Fed Day, it would be Tuesday morning's release of Job Openings. It will be the first big ticket data from the Bureau of Labor Statistics (BLS) for the month of October since the shutdown ended. It could be more closely watched than normal.

|

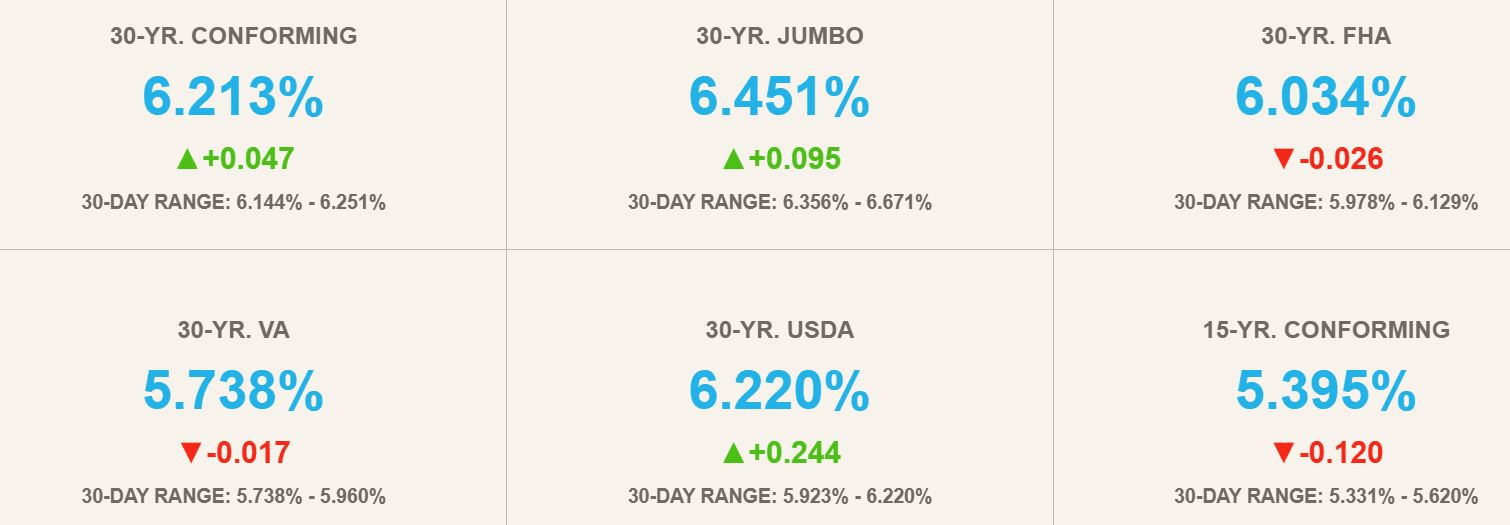

Mortgage Rates as of 12.5.2025 |